Posted December 03, 2025

By Davis Wilson

$600 → $87: A Valuable Lesson About Bubbles

There’s a tweet making its rounds.

I think it’s important for you to see and understand.

Here’s a screenshot:

This tweet has 6,500 likes and was viewed over 750,000 times.

The message is simple: Zoom once traded at $600 with tiny profits.

Yet today, with billions in profits, it sits near $87.

If Zoom could collapse like that… why couldn’t today’s AI companies?

It is a fair question and a useful one.

But like most tweets, it leaves out a lot of important details.

Let’s rewind to October 2020 – the peak of the Zoom bubble.

Everyone was stuck at home.

Stimulus checks were rippling through the economy.

Millions of first-time traders were chasing quick profits.

More importantly, Zoom’s business was booming thanks to the sudden shift to remote work.

So while the tweet does mention that Zoom only had $20 million in net income, it doesn’t mention that net income was expected to grow exponentially in the years ahead.

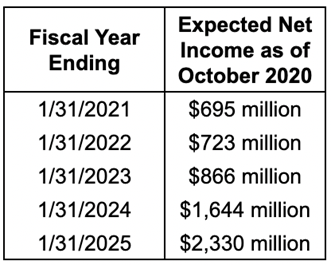

The way to read this is that as of October 2020, Zoom’s net income expectation for the year ending January 31, 2021 was $695 million.

Analysts expected that number to climb higher – all the way up to $2.3 billion in 2025.

That was enormous projected growth in only a few years.

The tweet also doesn’t mention how extreme Zoom’s 2020 valuation actually was.

At the time it traded around 600x earnings and about 100x sales.

Even if everything went right those numbers were stretched far beyond reasonable.

But of course, not everything went right…

Within weeks of Zoom hitting its all-time high, Pfizer and Moderna released promising COVID vaccine data.

That single headline instantly reshaped expectations for Zoom’s future demand.

Work-from-home went from “permanent shift” to “temporary necessity.”

Within weeks ZM fell from $600 to $350.

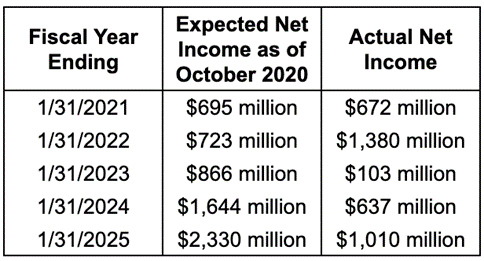

Over the next few months the world reopened and Zoom’s earnings reflected the change.

Those once explosive growth expectations were slashed.

Actual earnings came in far different from forecasts.

When growth disappears, valuation follows.

So could AI have its own version of Zoom’s collapse?

Absolutely.

Any fast-growing industry can experience a sudden reversal in expectations.

A regulatory decision, a breakthrough from a competitor, or a shift in enterprise demand could cause earnings estimates to fall sharply.

If that happens, stock prices will adjust quickly.

While Kevin Malone’s tweet does not name specific AI stocks, I agree that some names in the space are disconnected from reality.

Palantir (PLTR) is a good example.

The stock currently trades around 388x earnings and 110x sales with growing competition in the AI software space.

This alone doesn’t guarantee it will crash.

But it does mean the margin for error is incredibly thin.

Like Zoom, this kind of valuation can unwind quickly if expectations change even slightly.

Now it’s important to know that not all AI stocks are created equal.

Stocks that I discuss here in The Million Mission – like Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOG) – trade at far more reasonable valuations with earnings that are consistently being revised higher.

- Nvidia’s next year EPS estimates have climbed from $6.63 to $7.46 in just thirty days.

- Microsoft’s have increased from $18.19 to $18.63.

- Alphabet’s have moved from $11.01 to $11.14.

Nvidia has the highest P/E ratio of the bunch at just 44x.

None of this guarantees smooth sailing, of course.

Forecasting is tough even for experts.

But the evidence today still points in one direction: the AI buildout continues to accelerate.

Capital spending is rising. Earnings are rising. And the most important stocks in the space still trade at reasonable valuations.

If anything changes, you’ll hear it from me first.

But in the meantime, be careful with the viral takes.

Especially the ones that try to compress complex market cycles into 280 characters.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

Is NAK Safe?

Posted December 06, 2025

By Davis Wilson

Google Gemini + TPU → The Case for GOOG $3.8T

Posted December 01, 2025

By Davis Wilson

The NVDA Trade… Bitcoin… AI

Posted November 29, 2025

By Davis Wilson

The Strange Anomaly I’m Thankful For

Posted November 28, 2025

By Davis Wilson

Turkey & Drama: How To WIN Arguments on Thanksgiving

Posted November 26, 2025

By Davis Wilson